Tips For Investing In Housing And Then Renting

Investing in real estate is a time-tested and profitable way to grow your savings. It’s a robust source of income, and the advantages of purchasing property for investment purposes are numerous. In this guide, SPV Mortgages will explore why buying property to rent is a viable investment option and provide essential tips to ensure success.

Why is it a good option to buy and then rent?

Buying property to rent is an attractive investment choice for several compelling reasons:

Rental Profitability

One of the primary incentives for investing in real estate is the potential for rental income. The average rental yield in various locations can be quite substantial, often outpacing returns from other investment options.

In places like Zaragoza, for instance, the average rental yield is around 6.2%. This represents a steady stream of income that can significantly boost your financial portfolio.

Lower Risk

Real estate investment is renowned for being less volatile than investing in the stock market. While property prices may fluctuate, these fluctuations generally occur more gradually and predictably. Unlike the stock market, which can experience sudden and significant price swings, real estate often provides a more stable and secure investment platform.

Extra Income

Owning a rental property not only generates rental income but also offers various tax advantages. Additionally, property values tend to appreciate over the long term, allowing you to accumulate profits while your investment grows in value.

Better Than Saving

Traditional savings accounts and term deposits offered by banks often yield low interest rates, sometimes even lower than 0.6%. These passive savings are subject to maintenance fees, inflation, and other economic variables that can erode their value over time.

In contrast, real estate investments provide a tangible asset that safeguards your financial future and remains relatively resilient to economic fluctuations.

Tips for Investing

Financial Analysis

Your financial position is a pivotal consideration when contemplating real estate investment. Whether you have sufficient capital to purchase property outright or require a mortgage, you should assess your financial stability. Consider the following questions:

Do you possess the liquidity to cover the purchase price?

Is your income stable enough to handle the expenses of maintaining a second property? Is your employment situation secure enough to support a mortgage?

Addressing these questions confidently will help you avoid unforeseen financial challenges down the road.

Property Price

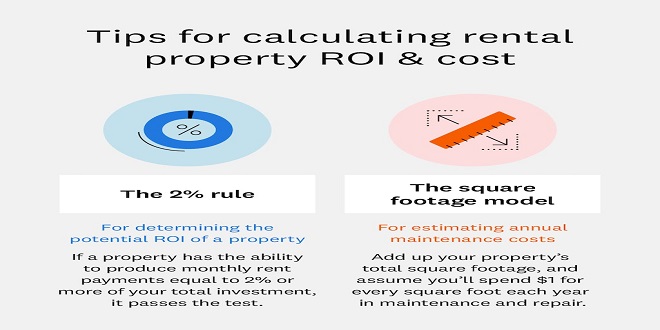

Success in real estate investment hinges on the price at which you acquire the property. Conduct a thorough analysis of the market, compare prices of similar properties, and leverage tools like the Price Earning Ratio (PER) to determine the time it takes to recover your initial investment. Ensuring that the numbers add up is a critical factor in achieving profitability.

Fixed Costs

To estimate the rental price and your profit margins accurately, you need to account for the fixed expenses associated with your property. These may include property tax (IBI), garbage collection fees, water bills, home insurance, and any necessary repairs. It’s vital to factor these costs into your financial projections to ensure that your investment generates a positive cash flow.

Market Research

Understanding the local real estate market is essential for success. Familiarize yourself with market trends, neighbourhood characteristics, and tenant demand in your chosen area. Researching these factors will help you make informed decisions about where to invest and what types of properties to consider.

Property Management

Managing a rental property can be time-consuming and may require expertise in tenant relations, property maintenance, and legal regulations. A property management company can handle these responsibilities for you, making your investment more passive and hassle-free.

Risk Mitigation

Diversify your real estate investments to mitigate risk.Spreading your investments across different properties or regions can help safeguard your portfolio from the potential negative impact of a localized market downturn.

Exit Strategy

Plan your exit strategy. Real estate investments are typically long-term, but circumstances may change. Be prepared for various scenarios, including selling the property, refinancing, or transitioning it into a different investment strategy when the time is right.

Legal and Tax Considerations

Understand the legal and tax implications of property ownership in your area. Consult with legal and tax professionals to ensure you comply with all relevant laws and regulations. Being well-informed about the legal and tax aspects of your investment can save you from costly mistakes.

Conclusion

Investing in real estate by buying property and renting it out is a tried-and-true method to grow your savings and secure your financial future. The advantages include rental profitability, lower risk compared to other investment options, the potential for extra income, and resilience to economic fluctuations.

To ensure success, you should conduct a thorough financial analysis, carefully assess property prices, account for fixed costs, conduct in-depth market research, and consider factors like property management, risk mitigation, and exit strategies.

With the right approach and diligent research, real estate investment can be a rewarding and lucrative venture. While this guide provides a solid foundation for your investment journey, remember that real estate investment is a complex field, and it may be beneficial to seek guidance from professionals who specialize in this area. They can offer insights and expertise to help you make informed investment decisions and maximize your returns.